This article is about the status of controlled foreign company, methods of CFC recognition, notices and calculation of CFC profit and how it is accounted for in Russian tax residents’ income.

Definitions

Recognition of a foreign company as a controlled foreign company

According to the Russian Tax Code (Article 25.13), a foreign organization is recognized as a controlled foreign company (CFC) when the following two conditions are met simultaneously:

- The foreign organization is not a tax resident of the Russian Federation;

- An organization and/or individual recognized as a Russian tax resident is a controlling entity of this organization.

Recognition of a CFC controlling entity as a Russian tax resident

The status of controlling entity of a foreign organization is awarded if one of the following conditions is met:

- An individual or legal entity has a participation interest in a foreign organization of more than 25%;

- An individual or legal entity has a participation interest in a foreign organization of more than 10% and the proportion of Russian tax residents’ participation in the foreign organization is more than 50%.

Participation does not result in the recognition of CFCs if:

- Russian tax residents participate in foreign companies through direct or indirect participation in Russian public companies;

- Russian tax residents hold shares in foreign companies through direct or indirect participation in foreign companies whose shares are traded on stock exchanges in OECD countries that exchange tax information with the Russian Federation on the following conditions:

- The controlling entity’s share of direct and/or indirect participation does not exceed 50%;

- The proportion of publicly traded shares does not exceed 25% of the share capital.

Tax exemption on CFC profit

CFC profit is exempt from taxation in any of two cases:

- The effective profit tax rate applied by a CFC is at least 75% of the weighted average rate applied in the Russian Federation provided the country of CFC registration and the Russian Federation have signed a:

- Double taxation treaty;

- Tax information exchange agreement;

- The CFC is an active foreign company.

To exercise the exemption right on these grounds, the Russian tax resident, which is a controlling entity, must submit to the Federal Tax Service documents confirming that the conditions for exemption are met. These documents must be translated into Russian and submitted together with the CFC notice.

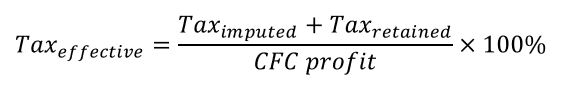

Determining effective tax rate on CFC profit. The effective tax rate is determined as follows, with possible adjustments for tax periods.

Determining weighted average profit tax rate. The weighted average profit tax rate is determined as follows:

CFC member of a consolidated group of taxpayers

For CFCs that are members of foreign consolidated groups of taxpayers, Н (tax calculated on income (tax imputed) + withholding tax (tax retained)) may be determined by the following methods depending on the company’s accounting policy adopted for 10 years (Article 25.13-1(2) Russian Tax Code):

- In proportion to the share of revenue in the group;

- In proportion to the share of profit in the group;

- In proportion to the share of net assets in the group.

Status of active foreign company

A foreign company is deemed active if the proportion of passive income does not exceed 20% as recorded in the CFC’s financial statements, excluding exchange rate differences, revaluation, and reserves from total revenues. The following types of income are considered passive:

- Dividends and distributed profit (including upon liquidation);

- Interest;

- Royalties;

- Income from the sale of shares (stakes), investment shares, investment units (in investment funds) and derivative transactions;

- Income from the sale of real estate property;

- Income from property rental;

- Income from the provision of consulting, legal, accounting, auditing, engineering, advertising, marketing, information processing services, as well as R&D;

- Income from staffing services;

- Other similar revenues.

Notice of participation in foreign organizations and CFC

Russian tax residents must notify the Federal Tax Service of their participation in foreign organizations:

- Within three months of the date of occurrence/change of participation interest;

- Annually:

- March 20 – deadline for individuals (for tax periods up to 2020) and for organizations to file CFC notices;

- April 30 – deadline for individuals to file CFC notices (for tax periods from 2020);

- March 28 – deadlines for filing profit tax returns including CFC profits.

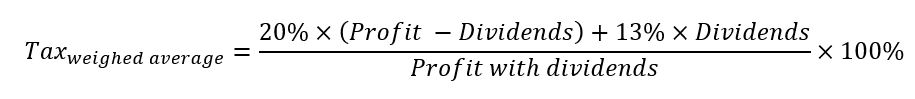

How CFC profit is included in controlling entity’s revenues

If the share of CFC profit determined in proportion to the participation interest in CFC, excluding dividends paid by CFC as well as dividends, royalties, and interest paid by the Russian organizations that are part of the CFC structure exceeds RUB 10 million, then such profit will be included for tax purposes in the controlling entity’s non-operating income.

Calculation of controlling entity’s income from CFC profit

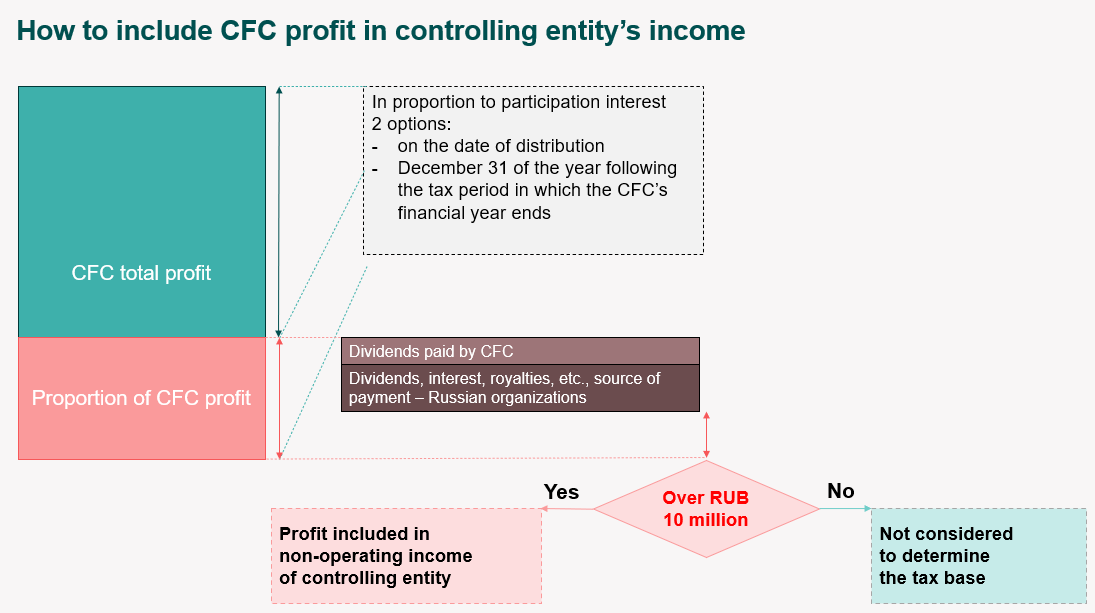

CFC profit accounting options

Countries in which a CFC audit is required to determine profit based on financial statemen

| Countries | Double taxation treaty | No tax information exchange |

| Anguilla | – | + |

| Andorra | – | + |

| Belize | – | – |

| British Virgin Islands | – | – |

| Virgin Islands, USA | – | + |

| Guyana | – | + |

| Gibraltar | – | + |

| Georgia | – | – |

| Monaco | – | – |

| Panama | – | – |

| Estonia | – | – |

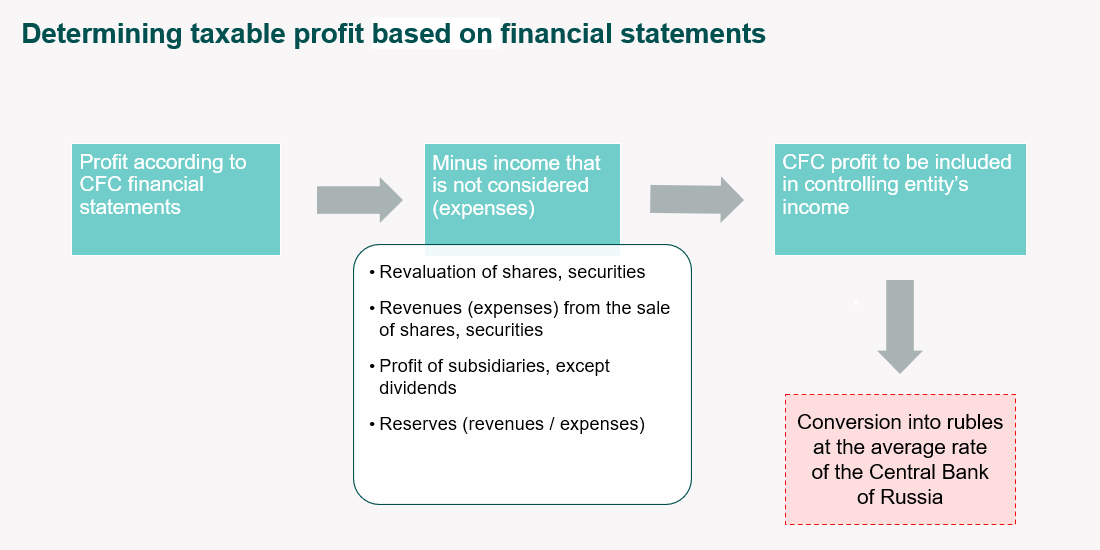

Determining profit based on financial statements

Letter from Federal Tax Service from 02.02.2021 № СД-4-3/1124@ about profit currency calculations (in Russian).

We offer controlled foreign company services. Feel free to contact us for advice.

Author

Evgeniy Sumin

- Deputy Director of Financial Consulting and Audit Department

Send message

Please describe your situation and we will find an optimal solution for your business.

info@konsugroup.com