Accounting for international companies in Russia

Almost all foreign companies operating in Russia have noticed that Russian accounting differs from how accounting is done abroad, but we are here to help, and we are happy to assist foreign companies in adjusting to Russian accounting.

- Accounting outsourcing

- International group reporting

- Express performance analysis of accounting

- Accounting recovery

- Switch to accounting outsourcing. How it is done

Accounting services

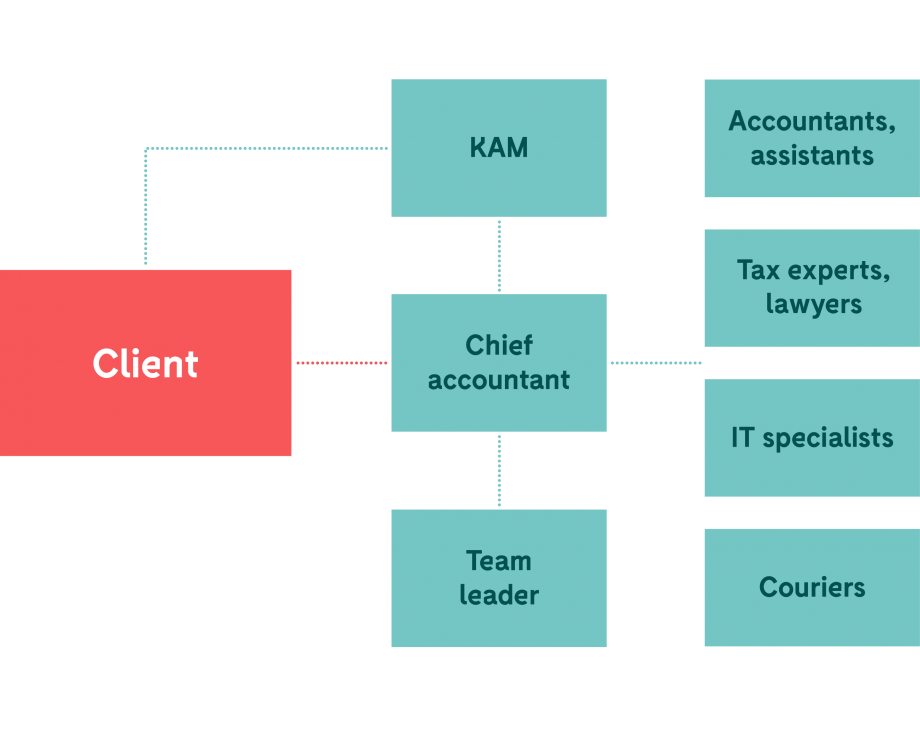

- A chief accountant;

- An accountant;

- An account manager;

- A lawyer.

Advantages of working with us

- We communicate in any language as required (Russian, English, German, Finnish, etc.);

Our team of specialists resolves legal, tax and accounting issues, drawing from the knowledge of 2,500 employees working in 7 countries in Northern Europe;

We proactively inform our clients of all upcoming changes in legislation;

Thanks to our well-tuned system, human factors are not an issue. Even the dismissal of an accountant, the maternity leave of an HR specialist or the errors made by a payroll officer do not affect our seamless operations;

We use modern IT solutions. For example, Konsu Extranet is a system that helps safely exchange data and improve communication with our clients;

If the volume of your business in Russia changes drastically, you do not need to worry about periodic hiring or dismissal of accounting and HR specialists.

We have been working in Russia with companies of various sizes and from various industries since 1992.

Throughout our 29 years of experience in Russia, we have managed to not only gain a lot of knowledge but also convert it into quality certified internationally and endorsed by AAA Dun & Bradstreet rating.

For our clients it is important that our employees be certified specialists with qualifications recognized by a global association of professional accountants.

Accounting outsourcing

Our accounting outsourcing model allows saving up to 40% compared to what needs to be paid for an in-house accountant. And working with us, you also get the experience and knowledge of the largest provider of accounting services in Northern Europe.

Find out more about accounting outsourcing services.

Preparation of group reporting for international companies

When foreign companies operating in Russia prepare their annual reports, they face the problem of matching the reports prepared under IFRS with the reports prepared under Russian law.

This problem stems from the fact that the international financial accounting system (IFRS) and the Russian accounting system (RAS) have historically served different purposes. IFRS reporting is required to analyse the economic indicators of an enterprise and is relevant to company owners, investors and other market entities. RAS reporting has been developed first and foremost for state control organizations (tax, statistical authorities, etc.)

We offer more to our clients than just adding Russian accounts to the general international system. We offer the opportunity to conduct group reporting in such a way so as to obtain a clear and transparent picture of the financial position of their company. Even if a company operates through several legal entities with their own accounts and subaccounts, we can consolidate all reporting and adapt it to the rules and regulations in place in the company. Thanks to monthly receipt of accurate data on cash flow, profits, losses and overall budget for Russian subdivisions, foreign companies can develop their business in the right direction!

Quick performance analysis of accounting and financial department

An effective accounting system should ensure that all business goals of companies (accounting, tax and management) are achieved.

When the management of a company considers that:

They receive from the accounting department unclear information about the company’s financial position and doubt the correctness of reporting;

The accounting department does not submit reports in due time despite an increase in staff and costs;

It is necessary to introduce changes to the accounting department.

A quick accounting system analysis is a swift and effective step to initiate changes in such case.

Accounting records recovery services

Poor accounting is one of the 5 main reasons for company bankruptcy. Without reliable and timely financial information about a company’s business, it is impossible to manage it. Accounting is therefore the most important tool for making the right management decisions.

If a manager – or worse, an external inspector – finds that the company has not kept its accounting properly, the company will have to restore its accounting records.

When accounting recovery is required

- A bank requests the financial statements of a company to approve a loan application, but the company has not kept its accounting properly

- Financial statements are requested by an auditor for due diligence before selling a business, but accounting has not been kept properly

- Accounting has been kept but mainly for tax purposes according to tax regulations, so reporting does not reflect the company’s actual financial result and financial position

- Accounting has been destroyed whether accidentally or deliberately (damaged database file, documents destroyed in a fire, flooding or other similar reason)

To find out more about our accounting recovery service, please feel free to contact us. We look forward to discussing any questions you may have about your company as well as proposing an action plan when we meet.