Although many companies operating on the Russian market use 1С for their accounting, we often encounter company executives who do not know how to conveniently retrieve and analyze data from this software.

In this article, we have reviewed the payroll reports from 1C. Each report in 1С comes with numerous variations and selection criteria that can be customized by 1C users for individual convenience. The examples provided in this article are based on standard settings that require no additional input from users.

Below we have reviewed the payroll reports that are most used.

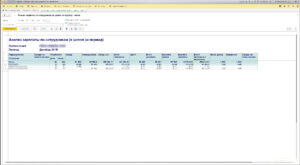

Salary Analysis

Where?

Salary –> Reports –> Salary Analysis

Main point

This report provides information about all accruals and payments for the selected period, as well as about the days and hours worked, broken down by divisions and employees. All accruals for the selected period can be viewed in Salary Analysis. Rows are for employees grouped by departments or separate subdivisions, while columns show the types of accruals and deductions. All payments, for example, advance payments, vacation payments, salary are shown on the right part of the report. The balance at the end of the month shows overpayment or underpayment, the amount owed by the company or employee.

How is it relevant to managers?

Using this report, managers can:

- Assess the proportion of payment for each division in the total budget;

- See the overtime worked by a specific employee to determine, for example, whether it makes sense to hire extra staff;

- Understand which payment constitutes the budget largest share. This information will point to how to find alternative solutions for budget cuts:

- For example, if business trip expenses are too high, resolving some issues remotely or finding staff in frequently visited cities could be considered as options to remedy this issue;

- If expenses for social benefits (e.g. sick pay or maternity benefits) are high, the accounting department could be requested to apply quicker for refund from the Social Security Fund.

The report offers 4 selection options:

- Organization. This data group is used if several legal entities are entered in 1С.

- Subdivision. This group is important to fill out personal income statements both 6NDFL and 2NDFL. Managers can also find out the salary expenses for each subdivision. The work performance of each subdivision may be assessed by comparing their expenses and profits. This is especially important in the initial stages as subdivision openings do not pay off immediately, and profits are generated later.

- Position. This selection criterion allows analyzing accruals for all sales managers, for example, as well as payments for business trip, bonuses, etc.

- Individual. Detailed information about accruals for the selected individual that should be taken into account upon dismissal, for example, to clearly see all payments (compensation for unused vacation days, severance pay, salary). The main thing is that the balance be equal to zero at the end of the month. If it is negative, this means that the departing employee is indebted to the company, and it will be necessary to find out the reason for such debt or recover it before he/she is dismissed. A positive balance means that the company owes money to the departing employee, and late payments will entail the recovery of compensation for each unpaid day.

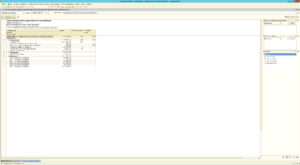

Summary of Accruals and Deductions

Where?

Salary –> Reports –> Summary of Accruals and Deductions

Main point

The results of various types of accruals for the selected period are summed up.

How is it relevant to managers?

This report allows easily monitoring fluctuations in various periods. Managers and analysts are required to compare payments for the current and previous years. For example, business trip expenses used to constitute a greater share of expenses, but since the opening of a branch in another city, they have decreased. Fixed salaries may also decrease if salaries are lower in this other city.

Another example, payments for the current and previous years are roughly equal for each line, but following the introduction of the new personal income statement (6NDFL), additional payments for work during public holidays and weekends have clearly increased. This could result in demotivation among the accounting staff as they spend their personal time. It may be worth, in such case, considering hiring extra staff.

Bookkeeping

Where?

Salary –> Reports –> Bookkeeping

Main point

This report provides information about the total amount of accruals for the selected period, taxes and social insurance contributions from these accruals.

How is it relevant to managers?

The report shows the changes in the amounts of social insurance contributions paid to the funds over a year and allows planning for the social insurance contributions to be paid the following year. For example, the social insurance contributions to the Pension Fund and to the Social Insurance Fund may decrease by the end of the year. The most important is to reach the threshold base for employee accruals. To calculate the social insurance contributions to the Pension Fund, the threshold base is RUB 1,021,000. Once this threshold is exceeded, the rate for social insurance contributions to the Pension Fund changes from 22% to 10%, and social insurance contributions to the Social Insurance Fund are no longer paid once the threshold base of RUB 815,000 is reached. In other words, the share of social insurance contributions to the Pension Fund and to the Social Insurance Fund in total accruals is considerably less than the initial 30% by the end of the year.

If the contribution thresholds are not reached, it is easy to forecast the costs of social insurance contributions as they consist of 30% of accruals except for non-taxable payments. However, most organizations exceed the threshold base and apply lower rates, and in such case, it is easier to take cues from the report for the past year rather than figuring it out without assistance.

Send message

Please describe your situation and we will find an optimal solution for your business.

info@konsugroup.com